Matthew Lee believes, “Consistent hard work leads to success.”

Life is filled with ups and downs, and for some, it may be due to various reasons such as family, work, or even personal life troubles. However, for many, finances might be one of the biggest concerns globally.

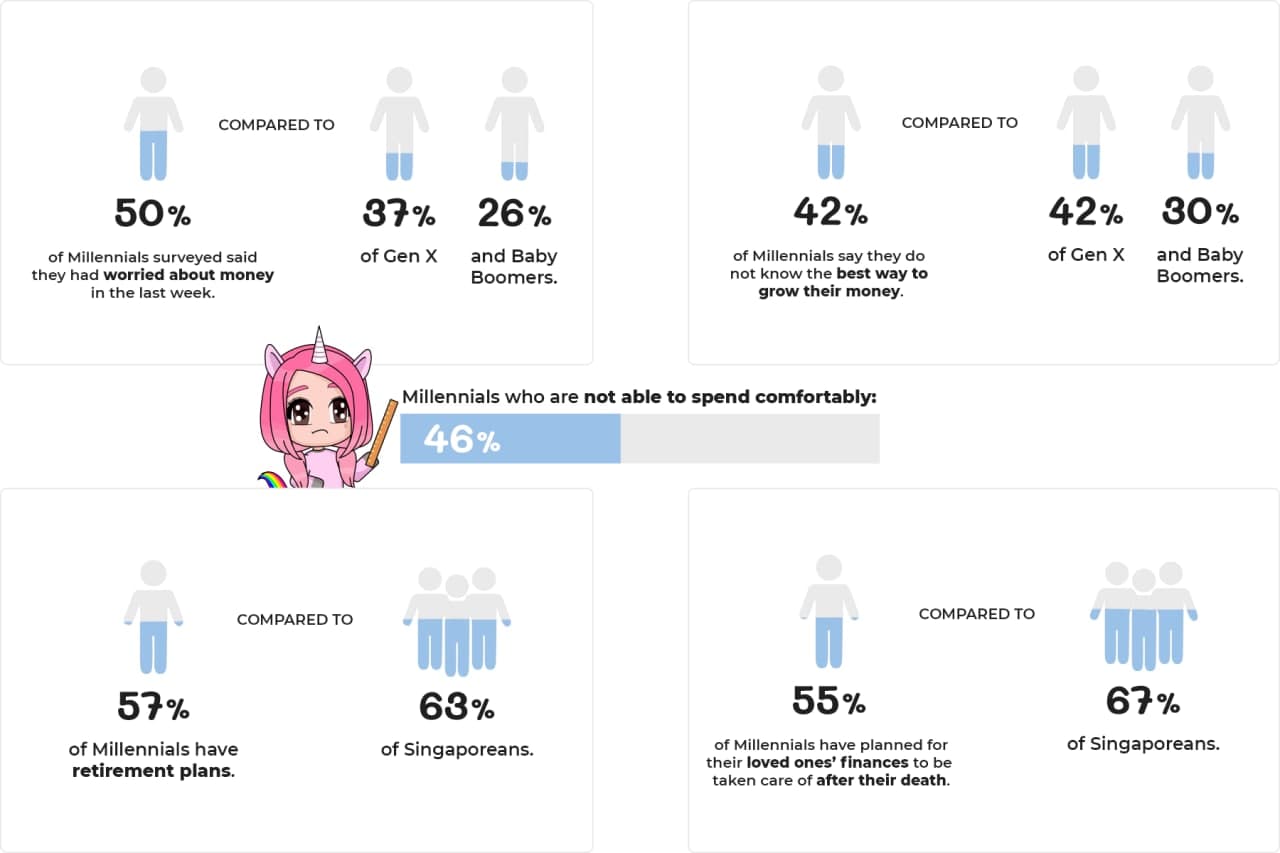

A survey done in 2020 conducted by OCBC as part of their financial wellness index surveyed 2,000 Singaporeans to gain insights into three different demographics, millennials, generation x, and baby boomers, about their financial habits and attitude.

A respective 49 percent, 37 percent, and 26 percent respectively of the 3-demographic worry about finances, yet only 28 percent of the respondents have passive income and only a mere 30 percent of the results shown to have sought out professional advice.

There are many available professional advisors out there. So, why is there still a considerable discrepancy, as shown in the statistics?

Perhaps a financial advisor’s scope is undermined and overshadowed by the outgoing nature needed for the job.

From an interview we did with Matthew Lee, a Manulife financial services consultant with a comical, eager and compassionate personality that plans to inspire and help as many as possible in their journey to achieving financial freedom, we got to better understand the scope at hand through him.

“I grow and protect my client’s money through various means and protect their income through insurances and grow their wealth through investments. It is a multi-faceted role.”

He added, “Sometimes it could be as simple as having a discussion about income allocation and then coming up with a quarterly goal to achieve, or other times, it could be as complex as planning an estate of someone with multiple dependents with complicated relationships.”

When asked about an interesting story in his life, his response speaks of inspiration, joy, and fulfilment. “When I just started back in 2019, my friends were quite supportive in letting me share with them my newfound knowledge in financial planning. After learning about these through me and while studying and working freelance gigs, one of my friends managed to save up a solid emergency fund in just a year! I was so proud of him, hands down one of my biggest accomplishments in life.”

Working his first job in Orchard Parade Hotel’s banquet team at 16, hustling is unquestionably in his name. On his rare days off, fishing with his friends allows him to destress from the hectic life, a humorous response when asked about it; “I am quite unlucky amongst my peers. I went to buy a new fishing rod, and that rod got me nothing till my 4th trip fishing.”

Recent statistics provided by the Singapore Employee Engagement Index states that almost 50 percent of Singaporeans are unhappy in their current jobs and will not recommend it. A journal research article states a correlation between happiness and career success whereby happier people receive higher earnings, exhibit better performance, and obtain more favourable supervisor evaluations than their less happy peers.

Incorporating this takeaway into his work life, Matthew mentions that, “The biggest ‘ah ha’ moment for me was three months into my job when I could proudly say, “I am a financial services consultant”. I know it sounds lame or overly simplistic. Still, if you do not own it, you will not be able to succeed.”

Choosing the right financial advisor with the intent of seeing you thrive and excel in life will not only equip you with the necessary fundamental knowledge but will also become a long-time friend that sees your growth through every milestone of your life, keeping you protected, financially stress-free, and an occasional fishing trip here and there 😉.

Get to know more about Matthew Lee on a personal level at @mattjustinlee on Instagram.

Interesting nuggets during our interview:

Q: What have you recently learnt that blew you away?

A: Okay, this is a little dry, but I recently spent 4 hours reading up on IRAS income tax reliefs and deductions. I am sorry, but that blew me away.

Q: If you’ve committed a crime, what would it be? How would you have done it and get away with it?

A: I don’t think I am allowed to answer this!!

Q: If you woke up and had 1,000 unread emails and could only answer 100 of them, how would you choose which ones to answer?

A: Okay, this question is giving me anxiety. I will reply to them according to urgency?

Q: Shameless plug?

A: Anything financial related, I am YOUR GUY!

Want to get featured next? Fill up this form.

Responses